Michael Gayed X - Looking At Market Behavior

There are moments in the world of money where someone comes along and offers a fresh way of seeing things, a different angle on how markets move. It is often a surprise to many, but these unique views can open up new thoughts about investing and how we make sense of the financial happenings around us. This kind of perspective helps people consider what might be coming next, or perhaps, what has been missed by others.

For those interested in understanding market patterns, or maybe just curious about what makes some people look at the financial world in a truly distinct manner, there are individuals who stand out. They approach the study of markets with a particular lens, focusing on signals that might not be obvious at first glance. It is about trying to figure out the subtle clues that markets give us, and then putting those pieces together in a meaningful way, you know, to form a bigger picture.

This particular discussion will introduce you to Michael Gayed, a person who has made a name for himself by exploring unusual market signals. We will talk about his ideas and how he looks at the financial landscape, offering a chance to think about how different approaches can shed light on complex topics. So, in a way, we are going to explore some of the ways he sees the world of finance, and what that might mean for anyone paying attention.

- Kareem Abdul Jabbar Pardon My Take

- Overtime Megan Sec

- Https Onlyfans Com Omgjasmin

- Js Slime Me Out Gng

- Serena Sanchez Chino

Table of Contents

- The Story of Michael Gayed

- Early Life and Education for Michael Gayed x

- What Makes Michael Gayed x's Approach Different?

- Looking at Market Anomalies with Michael Gayed x

- How Does Michael Gayed x Share His Ideas?

- Publications and Public Appearances by Michael Gayed x

- Why Does Michael Gayed x Focus on Unusual Market Signals?

- What Can We Learn From Michael Gayed x's Insights?

The Story of Michael Gayed

Michael Gayed is someone well-known in financial circles for his particular views on market actions. He has spent a good deal of time thinking about how markets behave, especially when things seem a bit out of the ordinary. His work often centers on what he calls "leading indicators" or signals that might give a hint about future market shifts. He looks at things that many people might overlook, like how different parts of the market move in relation to each other, or perhaps, how certain types of investments are doing compared to others. It is a way of trying to get ahead of the curve, or at least, to see patterns that are not immediately obvious. He has built a reputation for sharing these thoughts, often challenging commonly held beliefs about how investing should work. He wants people to think about things a bit differently, to question the usual ways of doing things, and to always be on the lookout for what the market is truly telling us. He has, in some respects, carved out a very unique space for himself by consistently putting forward these kinds of ideas.

Early Life and Education for Michael Gayed x

Michael Gayed's path into the financial world began with a solid academic background, which, you know, gave him a good foundation for his later work. He studied finance and economics at a university, gaining a deep sense of how financial systems operate and the theories that explain market movements. This early learning provided him with the tools to look at data and to think critically about economic principles. It is the kind of start that many people in finance have, giving them a broad sense of the field. However, it was his particular interest in market behavior that truly set him apart. He was not just interested in the standard ways of doing things; he wanted to explore the quirks and the less common aspects of how markets functioned. This curiosity, combined with his formal schooling, helped him develop his own distinct perspective. He picked up the basic ideas, naturally, but then he started to ask different kinds of questions about them. This blend of traditional education and a personal drive to look beyond the usual is pretty typical for people who end up making their own mark in a field like this, as a matter of fact.

What Makes Michael Gayed x's Approach Different?

What sets Michael Gayed's way of looking at markets apart is his focus on what he calls "asymmetric risk." This basically means he tries to find situations where the potential for things to go wrong is much smaller than the potential for things to go right. He is not just looking for growth; he is looking for situations where you have a better chance of gaining a lot while risking only a little. This is a bit different from how many people approach investing, where they might focus more on just picking things that are expected to grow. He pays close attention to how different parts of the market interact. For instance, he might look at how certain types of stocks behave when bonds are doing something specific, or how different groups of companies are performing compared to others. He believes these relationships, or lack thereof, can give you hints about what might happen next. He uses a lot of data to back up his ideas, trying to find patterns that repeat themselves over time, which, you know, can be pretty helpful for making sense of things. It is about finding those moments when the odds seem to be tilted in your favor, even if just slightly, and then acting on that information.

- Boynextdoor Photocard Template

- Carmela Mcneal Nude

- Chris Evans Armpits

- Fenella Fox Masturbate

- Re Born Ryo 2

Looking at Market Anomalies with Michael Gayed x

Michael Gayed spends a lot of his time observing what he calls "anomalies" in the market. These are situations or patterns that do not quite fit the usual explanations or theories about how financial markets should work. Think of them as strange occurrences that pop up now and then, which, if you pay close attention, might actually tell you something important. For example, he might notice that certain types of assets, like stocks of very small companies, are acting in a way that is unexpected when compared to larger companies, or perhaps that certain sectors are moving in a direction that goes against the general market trend. He tries to figure out why these unusual things are happening and what they might mean for the bigger picture. He believes these anomalies are not just random noise; rather, they are signals that can give you a heads-up about shifts that are coming. It is like trying to spot the early signs of a change in the weather by looking at the clouds, instead of just waiting for the rain to start. He collects a lot of information and puts it together to see if these odd behaviors are actually part of a larger, hidden pattern. This kind of work requires a lot of patience and a willingness to look beyond the surface, which, as a matter of fact, is something he is quite good at doing.

How Does Michael Gayed x Share His Ideas?

Michael Gayed shares his thoughts and research in several ways, making his ideas available to a broad audience. He writes articles and papers that explain his market observations and the thinking behind them. These writings often appear on financial news websites and in specialized publications, where people who are interested in market analysis can find them. He also makes regular appearances on financial television shows and participates in podcasts, where he talks about current market conditions and what his models are suggesting. These appearances allow him to explain his ideas in a more conversational setting, reaching people who might not read academic papers. He is also quite active on social media, using platforms to share quick insights, respond to questions, and point to his latest work. This direct way of communicating means that people can get updates from him pretty regularly. He wants to make sure his unique way of looking at things gets out there, to help others think about markets in a different light. It is about getting his message across, in a way, to anyone who is willing to listen and consider a new viewpoint, which is pretty important for someone who has a distinct perspective like his.

Publications and Public Appearances by Michael Gayed x

Michael Gayed has put out a number of pieces of writing and has been seen on many public platforms, all to share his ideas about financial markets. His written work often includes detailed studies on market behavior, particularly focusing on what he calls "leading indicators" and how they might hint at future price movements. These writings are often picked up by well-known financial news outlets, giving them a wide readership among those who follow market trends. He has also been a frequent guest on television programs that cover finance, where he discusses his market outlook and answers questions about current economic situations. These TV spots allow him to explain complex ideas in a way that is easier for a general audience to grasp. Moreover, he participates in various financial conferences and events, speaking to groups of investors and other professionals. These talks provide an opportunity for him to present his research directly and to engage in discussions about the future of markets. He uses these different ways of communicating to make sure his distinct views are heard, which, you know, helps to spread his particular way of thinking about market signals. It is clear he puts a lot of effort into getting his message out there, honestly, trying to influence how people look at investing.

Why Does Michael Gayed x Focus on Unusual Market Signals?

Michael Gayed's focus on unusual market signals comes from a belief that the most important information is often found where others are not looking. He thinks that if everyone is paying attention to the same things, then those things have probably already been "priced in," meaning their impact is already reflected in current market values. To find a true advantage, or to see something coming before most people do, you have to look at the less obvious indicators. He is particularly interested in what happens when different parts of the market start to behave in ways that do not make sense according to standard economic models. For instance, if a certain type of stock that usually moves with the overall market suddenly starts to go in the opposite direction, that might be an unusual signal worth investigating. He sees these odd movements as clues, almost like whispers from the market that something bigger might be brewing. It is a way of trying to catch shifts early, before they become widely known. This approach is rooted in the idea that markets are not always perfectly efficient, and that there are moments when unique patterns emerge that can offer insights. He is, in some respects, always searching for those subtle hints that can give a clearer picture of what is really going on beneath the surface, which is pretty fascinating, really.

What Can We Learn From Michael Gayed x's Insights?

We can learn several things from Michael Gayed's way of looking at financial markets. One important lesson is the value of independent thinking. He shows us that it is worthwhile to question commonly accepted ideas and to look for information in places that are not always obvious. Instead of just following the crowd, he encourages a deeper examination of market data to find unique patterns. Another takeaway is the importance of looking at how different parts of the market relate to each other. He often talks about "intermarket analysis," which is basically observing how things like stocks, bonds, and commodities move in relation to one another. This can give you a more complete picture of what is happening in the financial world, rather than just focusing on one area. His work also highlights the idea that markets are not always rational or predictable. There are times when unusual things happen, and these "anomalies" can sometimes be more informative than the usual trends. So, in a way, he teaches us to be open to different possibilities and to consider that the market might be sending us signals that are not immediately clear. It is about developing a curious mind and a willingness to explore beyond the surface, which, honestly, is a good skill to have for anyone interested in finance.

Summary of the Article's Contents

This article has given us a look into the work and ideas of Michael Gayed, a financial analyst known for his unique approach to market behavior. We started by understanding his background and how he came to develop his distinct perspective. We then explored what makes his method different, particularly his focus on finding situations where the potential for gain outweighs the risk, often by looking at unusual market signals. The discussion also covered how he shares his insights, through various writings and public appearances, making his ideas accessible to a wide audience. Finally, we considered the valuable lessons that can be taken from his approach, emphasizing the importance of independent thinking and observing the relationships between different parts of the market to uncover hidden patterns.

- Kareem Abdul Jabbar Pardon My Take

- Oh So Juicy Model

- Cm Punk Mickie James

- Is Gmovies Down

- Icl Ts Pmo Copy Paste

15 singers who've been called the next Michael Jackson - Houston Chronicle

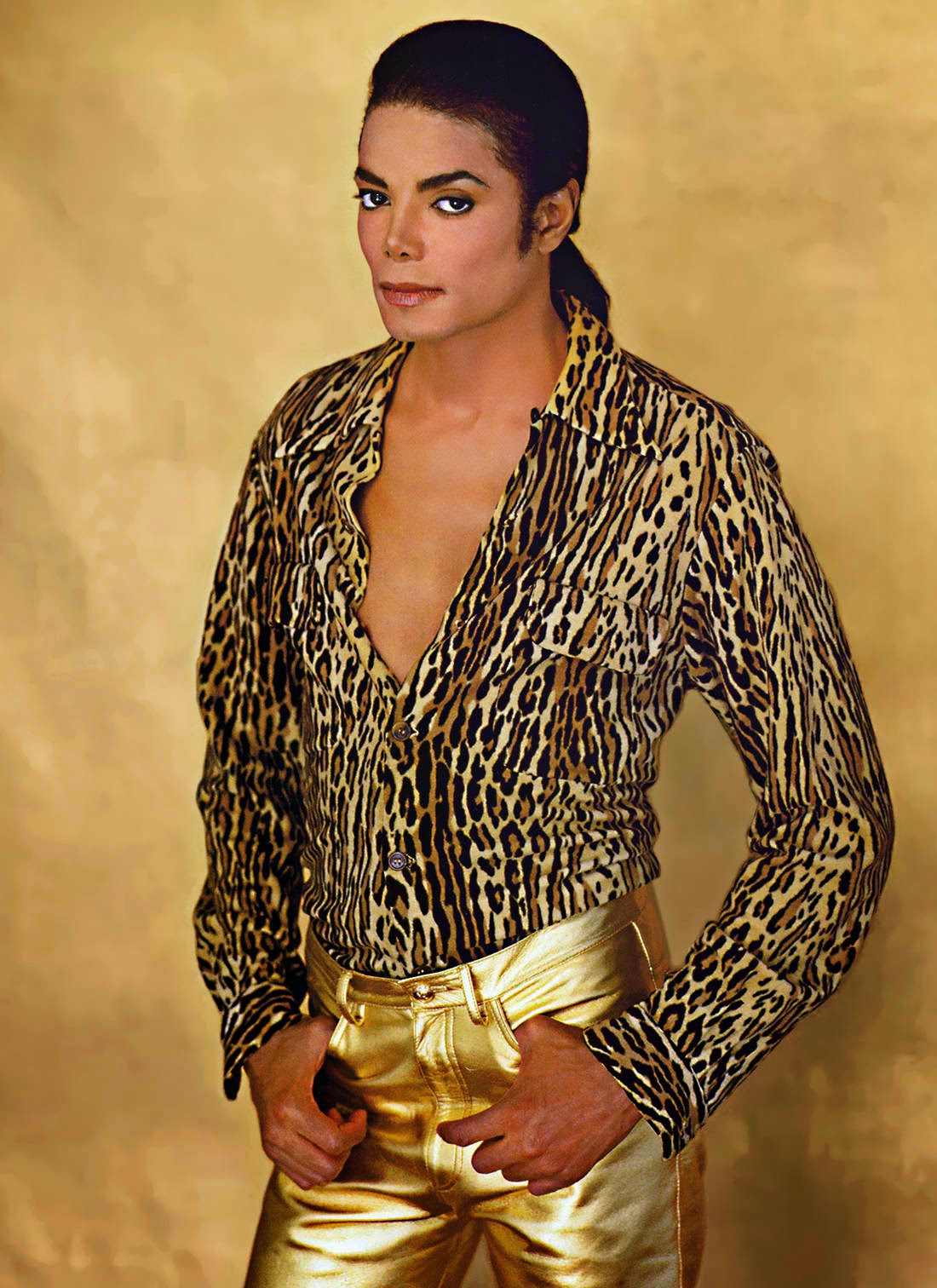

~ The Magic of the Bad Era ~ - Michael Jackson Photo (19148971) - Fanpop

Rare & beautiful HQ photos of Michael Jackson ~ HD WALLPAPERS