Bill - Making Business Finances Feel Easy

Running a small company or even a bigger operation often means dealing with a mountain of paperwork and figuring out where every penny goes. It's a lot to keep track of, from making sure bills get paid on time to sending out requests for money you're owed. You might find yourself wishing there was a simpler approach, a way to handle all those financial bits and pieces without feeling swamped. Well, as a matter of fact, there are tools out there that aim to take a lot of that heavy lifting off your shoulders, helping you get a clearer picture of your money situation with a good deal less effort.

This whole idea of simplifying how businesses handle their money tasks isn't just a pipe dream; it's something many folks are looking for, especially when every moment counts. Think about it: instead of spending hours sorting through receipts or chasing down payments, you could be focusing on what you actually love doing, like growing your business or serving your customers. It’s about getting things set up so that the routine money stuff just, you know, flows more smoothly, giving you back precious time and peace of mind.

What if you could put together what you owe, send out payment requests, keep an eye on where your funds are going, guide your spending plans, and even get access to financial backing your company needs, all from one spot? That's the kind of practical assistance some financial platforms offer. They aim to make those often-tricky parts of managing money feel, well, a bit less tricky, helping you stay on top of things without the usual fuss. It's about bringing a sense of order to what can sometimes feel like a financial jumble.

Table of Contents

- What Does It Mean to Make Finances Simple?

- How Does Bill Help Manage Money?

- Who Is This Financial Helper For, Anyway?

- Can You Really Get Your Money Tasks on Autopilot?

- Need a Little Help? What Are Your Options?

- Is Managing Money on the Move a Real Thing?

- How Does This Tool Play Nice with Others?

- What's the Deal with Different Account Types?

What Does It Mean to Make Finances Simple?

When we talk about making finances simpler for a company, it’s about more than just having a nice-looking spreadsheet. It’s about creating a flow where money comes in and goes out without causing a headache. Think about how much time you or your team spend on things like putting together invoices, making sure they go out, and then checking if they’ve been paid. Or perhaps it's the time spent gathering up all the receipts and trying to figure out where the money went this month. A simplified approach, you know, means less of that manual back-and-forth, fewer chances for small mix-ups, and a clearer view of your financial picture at any given moment. It’s about bringing a sense of calm to what can sometimes feel like a pretty chaotic part of running a business, allowing you to focus on the bigger picture, which is, honestly, what most business owners really want to do.

How Does Bill Help Manage Money?

This particular system, often called Bill, offers a way to handle several key financial tasks. It’s set up to be a pretty intelligent way to put together and settle what you owe, dispatch requests for payment, keep tabs on where money goes, guide your spending plans, and even reach out for financial backing your company might need. It aims to pull all these different threads together into one place, so you don't have to jump from one program to another, or from a digital file to a physical one. That, in a way, is the whole point – making the entire process feel a good deal more connected and less fragmented. So, you might find that the daily grind of financial upkeep becomes, you know, a bit more manageable with a tool like this on your side, helping you keep things straight.

Paying What You Owe, When You Owe It

One of the basic things any business needs to do is pay its bills. It sounds straightforward, but when you have many different suppliers, varying payment dates, and different amounts, it can get tricky pretty quickly. This kind of system helps you put together all those things you need to pay, making it easier to keep track of them. You can, for instance, see what’s coming up, what’s overdue, and what you’ve already taken care of. Then, when it’s time to actually send the money, you can do that right from the same spot. This means less worrying about missing a due date or forgetting about a small vendor. It’s about bringing a bit of order to the outgoing money, making sure everything is settled in a timely fashion, which, as a matter of fact, is pretty important for keeping good relationships with those you work with.

- Paco Amoroso Lady Gaga

- What Ligament Tears Did Joe Burrow Had On His Wrist

- Cooking With Kya Leak Tape

- Aisha Ali Khan

- Js Slime Me Out Gng

Getting Paid Back, Without the Fuss

Just as important as paying what you owe is getting paid for the work you do or the goods you provide. Sending out requests for payment, or invoices, is a big part of that. This platform helps you dispatch those requests to your customers. It’s about making that part of the process simpler, so you can get your money quicker and with less hassle. You can create them, send them off, and then, you know, keep an eye on their status. Did the customer get it? Have they viewed it? Has it been paid? All these little pieces of information help you stay on top of your incoming money, which is, obviously, pretty vital for any business. It helps you keep that financial pulse strong, ensuring that the funds you're expecting actually arrive without too much back-and-forth.

Keeping an Eye on Where Money Goes

It’s very easy for money to slip through the cracks if you’re not really paying attention to where it’s going. Keeping track of where money goes, or managing expenses, is a critical part of financial health for any company. This system helps you record every little bit of spending, so you have a clear picture of what’s being spent and on what. Whether it’s office supplies, travel costs, or even those smaller, everyday purchases, you can log them all in one spot. This means you can easily look back and see patterns, identify areas where you might be spending a bit too much, or just confirm that everything is being accounted for properly. It’s about having that oversight, that clear view, which, honestly, can make a significant difference in how well your business operates over time.

Smart Ways to Handle Your Spending Plan

Beyond just keeping track of spending, a good financial tool helps you guide your spending plans. This means setting limits and sticking to them, making sure you don’t overspend in any one area. This kind of platform can give you the tools to put those spending plans into action, allowing you to set up categories and allocate funds. It’s about being thoughtful with your money, rather than just letting it flow freely. When you have a clear spending plan and the means to follow it, you can make smarter choices about where your company’s money goes. This, you know, can help you save money, invest more wisely, and just generally have a healthier financial outlook. It’s about being proactive, rather than reactive, with your company’s financial resources.

Who Is This Financial Helper For, Anyway?

You might be wondering if this kind of financial assistance is a good fit for your particular situation. Well, it seems that the companies that use this system come from all sorts of backgrounds. Whether you run a tiny startup with just a few people, or a much larger operation with many departments, this kind of tool is made to fit different kinds of companies and even accounting firms of all sizes. So, it’s not just for one specific type of business; it’s pretty flexible. The idea is to have plans and pricing that can adjust to what you need, whether you’re just getting started or you’ve been around for a while and have a more complex setup. It’s about providing something that can grow with you, which is, you know, pretty handy for any company looking to manage its money better over time.

Can You Really Get Your Money Tasks on Autopilot?

One of the big draws of these kinds of systems is the promise of setting things up to run on their own. We’re talking about taking those repetitive money tasks, like dealing with what you pay out (often called AP) and what you get in (AR), and having the system handle a good portion of them for you. It’s a bit like having a helpful assistant who never gets tired of doing the same thing over and over. This means less time spent on manual entries, fewer chances for little errors, and generally a much quicker process for handling your company's money. It’s about freeing up your team to do more important things, rather than getting bogged down in routine paperwork. So, yes, in some respects, you really can get a lot of your money tasks to pretty much run themselves, which is, frankly, a huge relief for many businesses.

Taking Care of What You Pay Out

Automating what you pay out means that the process of receiving a bill, getting it approved, and then sending the payment can be largely handled by the system. Instead of someone manually entering every bill, checking it against a purchase order, and then scheduling a payment, much of that can be streamlined. The system can, for instance, help route bills for approval to the right people, remind you of due dates, and even initiate payments automatically once approved. This really cuts down on the time and effort involved in making sure your suppliers and vendors get paid on time. It’s about creating a smooth, almost hands-off flow for outgoing money, which, you know, can prevent late fees and keep your relationships with suppliers in good standing. It makes a typically tedious process feel much less so.

Making Sure You Get What's Coming In

Similarly, automating what’s coming in, or accounts receivable, means that sending out invoices and tracking payments can be set up to run more or less on their own. The system can help you create professional-looking requests for payment, schedule them to go out at specific times, and then, you know, keep an eye on when they’re due and if they’ve been paid. It can even send friendly reminders to customers if a payment is getting close to its due date or if it’s a little overdue. This helps you get your money quicker and more consistently, which is, honestly, vital for your company’s financial health. It reduces the need for someone to manually follow up on every single payment, freeing up their time for other tasks. So, in a way, it helps keep your cash flow moving along nicely, without you having to constantly push it.

Need a Little Help? What Are Your Options?

Even with the most straightforward systems, there are times when you might just need a bit of assistance or have a question pop up. When you need help with your account, there are ways to get in touch. You can visit what they call the Bill help center, which is a place for getting assistance. There, you can find out about the hours when support is available, chat with a real person, or even ask for someone to call you back. It’s about making sure that when you hit a snag or just have a query, you’re not left guessing. They try to make it pretty simple to reach out and get the guidance you need, which, you know, is a good sign of a system that really cares about its users. It’s about providing a safety net, so you feel supported when using the tool.

Is Managing Money on the Move a Real Thing?

In today's busy world, many people are not always sitting at a desk. So, the idea of managing money on the move is, as a matter of fact, very much a real thing. This kind of system lets you handle a good deal of your financial tasks right from your phone or other portable devices. You can, for instance, look over and give a nod to what you owe when you’re out and about, and even send payments with just a quick tap. It’s about giving you the flexibility to keep your company’s money matters moving forward, even when you’re not in the office. This means you don’t have to wait until you’re back at your computer to approve something important or make a necessary payment. It’s about making sure your financial operations don’t slow down just because you’re not in one specific spot.

Approving Bills from Just About Anywhere

Imagine being able to look over and give a nod to what your company needs to pay, even if you’re at a coffee shop, or perhaps just at home. This system lets you handle those approval steps quickly and easily from your mobile device. So, you don’t have to delay a payment just because you’re not in front of your desktop computer. This can really speed up the process of getting things paid and keeping your suppliers happy. It’s about putting the power of financial oversight right into your hand, allowing you to keep things moving without being tied down to a single location. That, you know, can make a pretty big difference in how efficiently your company operates, especially if you or your team members are often on the go.

Finding Important Papers, No More Digging

One of the biggest headaches for many businesses is keeping track of all their important papers. Think about all those past requests for payment, proof that something was paid, and other supporting documents. This system helps you say goodbye to paper piles by letting you easily pull up those old payment requests, proof of payment, and other supporting documents right from your computer or phone. It’s about having everything organized in one digital spot, so you don’t have to spend time rummaging through filing cabinets or trying to remember where you saved that one specific file. This makes finding what you need much quicker and simpler, which, honestly, can save you a good deal of time and frustration. It’s about making sure your financial history is always at your fingertips, ready when you need it.

How Does This Tool Play Nice with Others?

A financial tool is often more useful when it can work together with other programs you already use. This particular system links up with well-known money tracking programs and other financial process tools. This means it can help you cut down on typing things in by hand, make balancing your books quicker, and just generally make each part of your daily tasks easier. You won’t have to transfer information from one place to another, which, you know, can save a lot of time and prevent errors. It’s about creating a connected flow for your financial information, so everything works together smoothly. This

- Stl City Sc Black Arm Bands

- Daisy Keech Leaked Of

- Lavelle E Neal Iii

- Swat Deacon Shirtless

- Cm Punk Mickie James

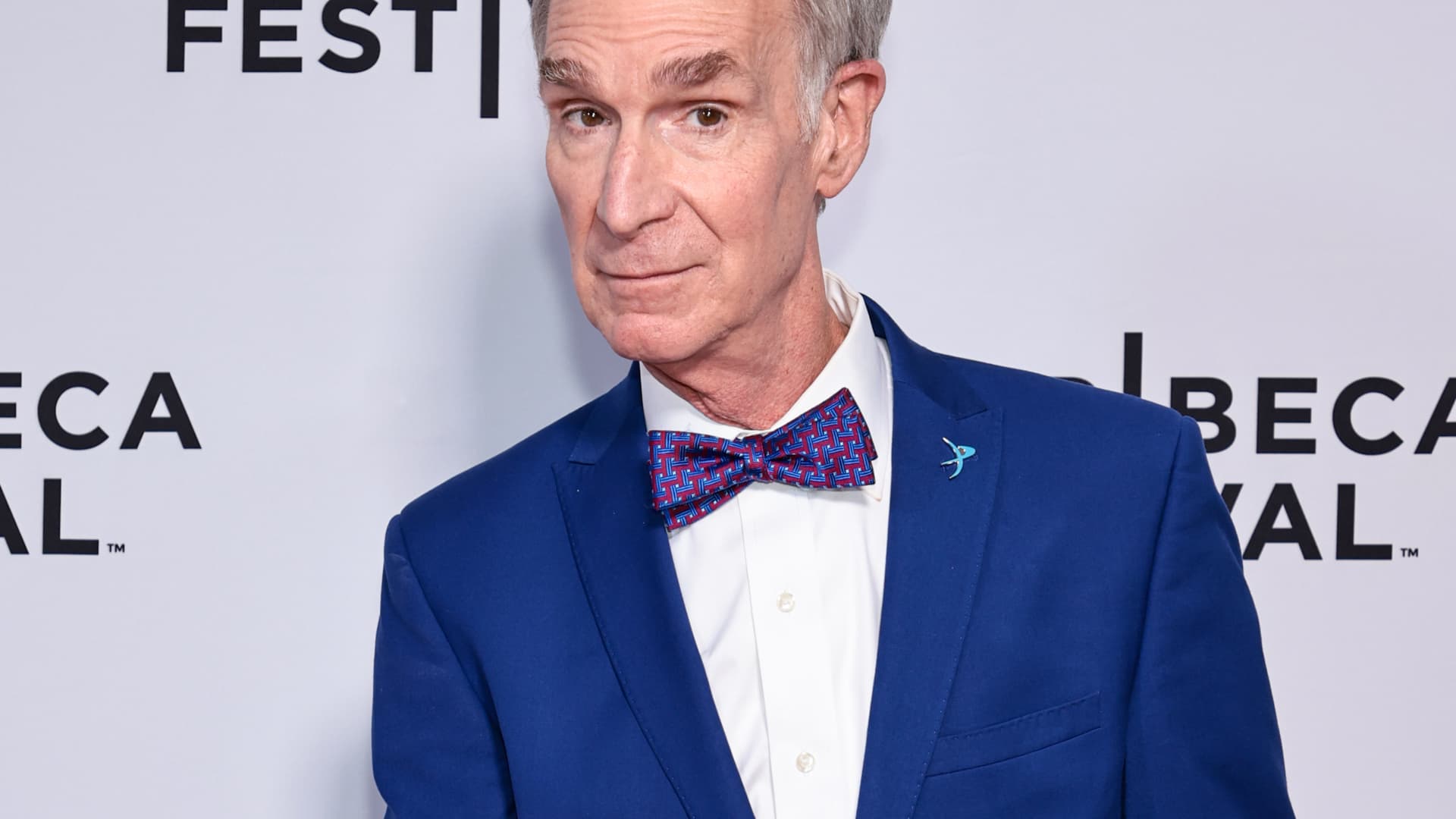

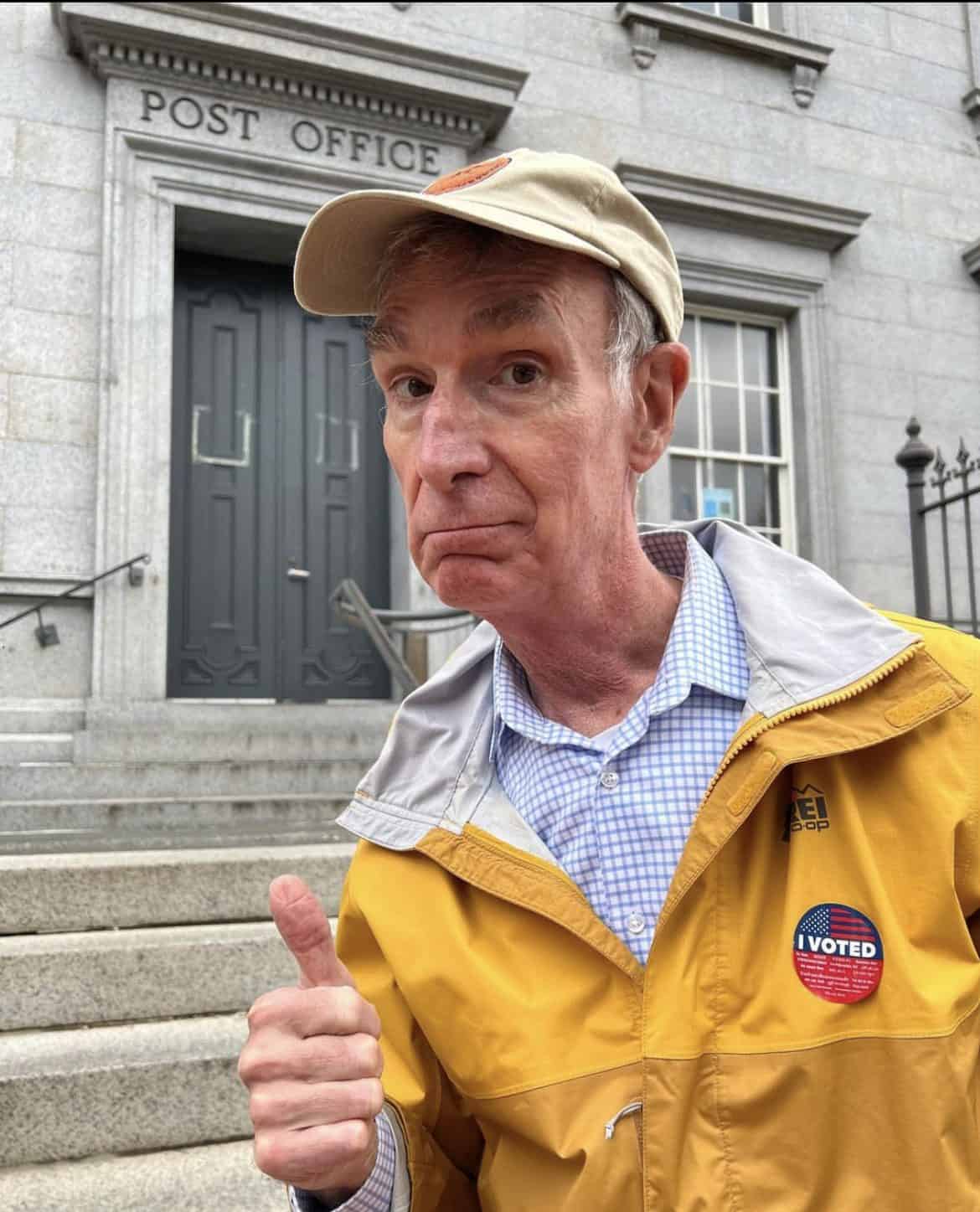

Bill Nye: The best way to fight climate change is by voting

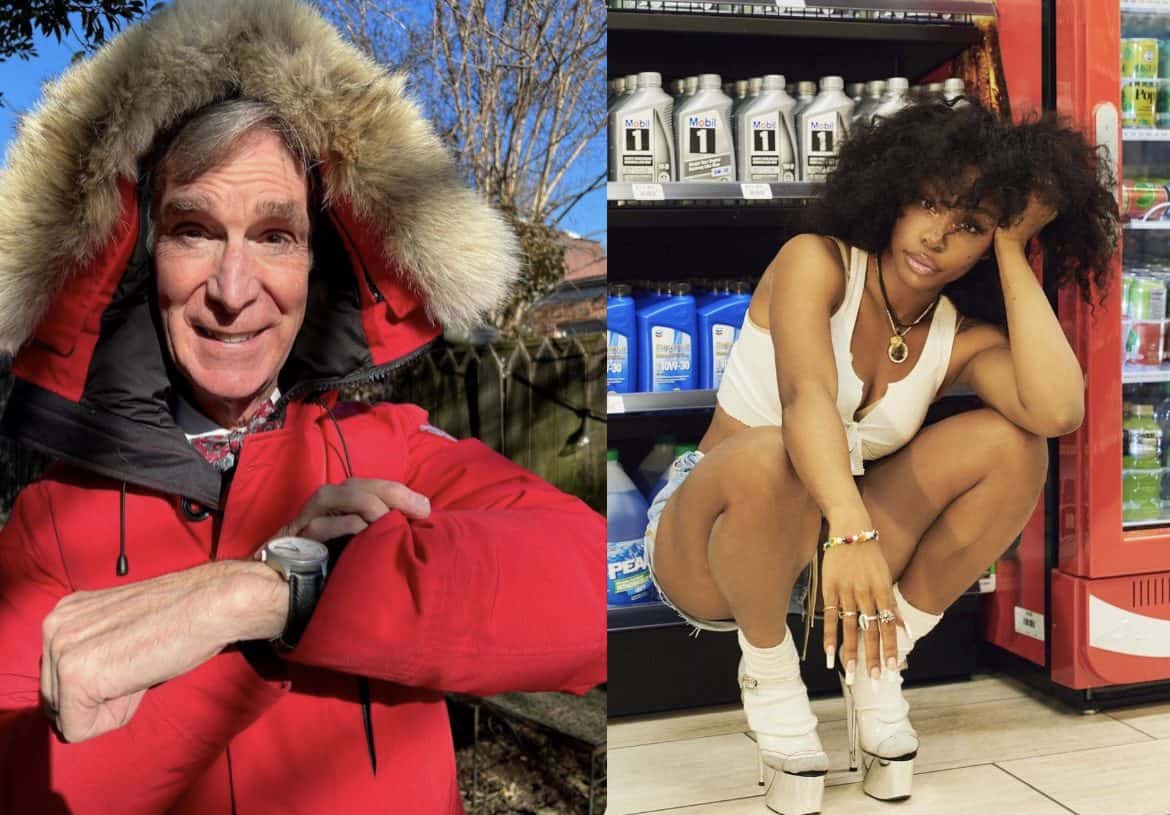

Are SZA and Bill Nye Dating? The Rumor Explained

Are SZA and Bill Nye Dating? The Rumor Explained