Chime Glitch 2025 - What You Need To Know

There's been some talk, you know, a sort of quiet buzz, about a possible "Chime glitch 2025." It's not about something happening right now, but more of a thought about what could happen with a service many people use for their money. We're looking at what folks have said about Chime, both the good bits and the less good ones, to get a better sense of things. This way, we can think about what a future hiccup might look like and what it might mean for those who keep their funds there.

When you put your money somewhere, you want to feel pretty good about it, right? People often wonder if Chime is a good place for their cash. Some folks have had a rather quick start, getting their cards in about a week and a half, which is, you know, a decent turnaround. Others have considered making a switch because they hear about how Chime might not charge certain fees, which is a big draw for many trying to keep more of their earnings.

But, there are also different feelings about how things go when a situation pops up that needs sorting. Some people who have been with Chime since, say, 2016, have shared that when a difficulty arises, getting help or feeling looked after can be a bit of a worry. It's a mix of experiences, really, and getting a full picture helps us all think a bit more clearly about what might come down the line, especially when we consider the idea of a "Chime glitch 2025."

- Stl City Sc Black Arm Bands

- Syren De Mer Selfie

- Guerschon Yabusele Butt

- Luke Bennett Onlyfans Leaks

- Orale Que Chiquito Dgo

Table of Contents

- What is Chime, Anyway?

- Is Chime a Good Choice for Your Money?

- What Happens When Things Go Wrong?

- Can a "Chime Glitch 2025" Affect Your Credit Building?

- How Does Chime Compare to Other Services for Early Payments?

- What About the Technical Side of Things?

- Do Chime and Its Partners Stand Behind Everything?

- What Could a "Chime Glitch 2025" Mean for You?

What is Chime, Anyway?

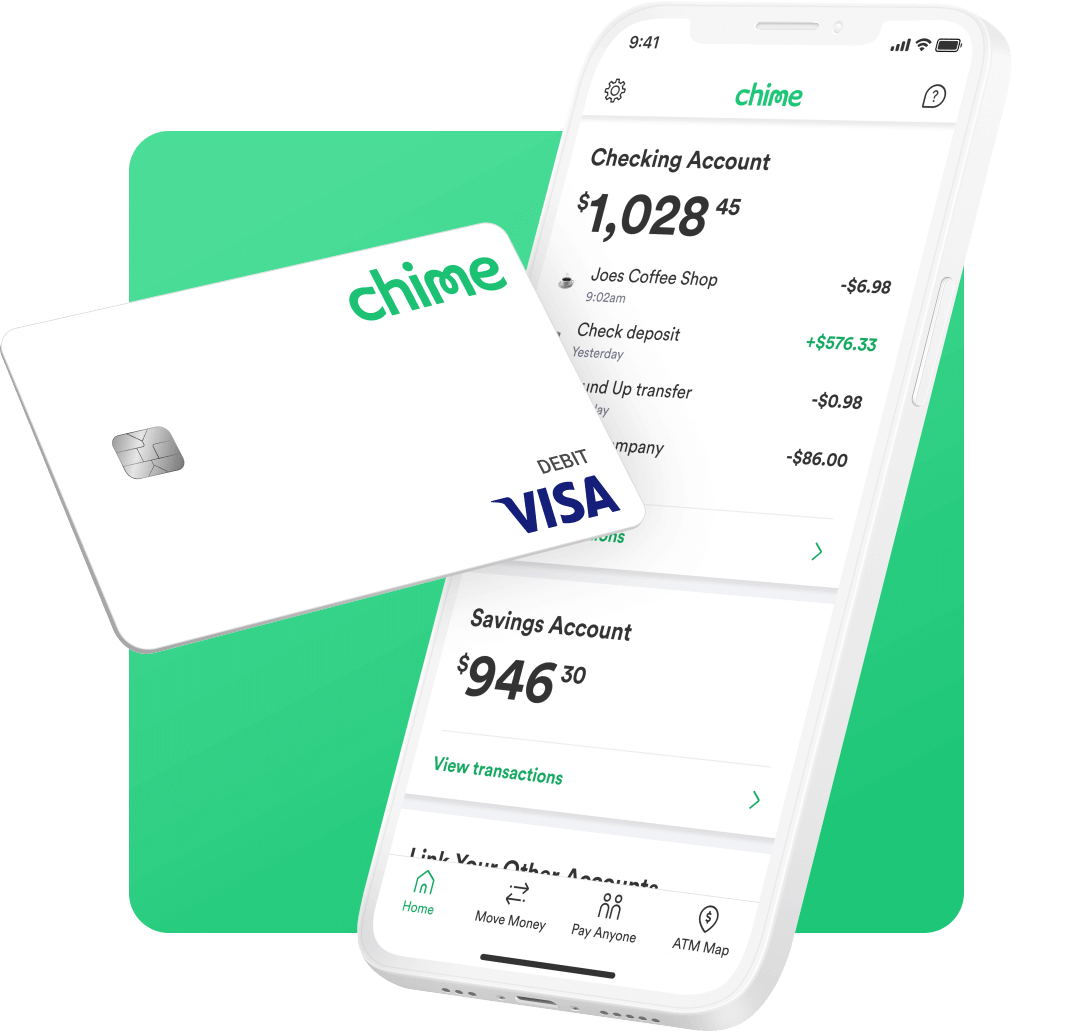

So, a lot of folks wonder about Chime and what it actually is. It's not, you know, a traditional bank in the way you might think of one. Chime is set up as a financial technology company. What that means, in a way, is that it uses cool computer programs and online tools to help people with their money. It does this by working with a real, established bank to provide all the services you'd expect, like holding your money and letting you spend it.

This setup is pretty common these days, as a matter of fact. Chime works with a place called The Bancorp Bank, N.A. This bank is a member of the FDIC, which means your money, up to a certain amount, is looked after by the government if something unexpected were to happen to the bank itself. So, while Chime handles the user-facing side of things, the actual money holding part is done by a proper bank. This arrangement is important to keep in mind when you think about any possible "Chime glitch 2025" or just how the service generally operates.

The Core Idea Behind Chime and the Bancorp Bank Connection

The core idea behind Chime is to offer a different kind of money experience, one that leans heavily on digital tools and, you know, a more modern approach. They aim to make managing your funds simpler and more accessible. By teaming up with The Bancorp Bank, they get to offer official banking services without having to be a bank themselves. This partnership is pretty key to how Chime works and how it presents itself to people looking for a place to keep their earnings. It’s also a point to remember when considering what might happen if there were a "Chime glitch 2025," as both entities play a part in the overall service.

Is Chime a Good Choice for Your Money?

When someone is thinking about where to put their money, they often ask, "Is Chime a good place to use?" Some people have already taken the step of ordering a card and have been quite happy with how quickly it arrived, like in a week and a half, which is pretty fast. That kind of quick start can make a good first impression, you know? It shows that at least some parts of the service work pretty smoothly from the get-go.

Then there's the talk about fees, or rather, the lack of them. A big reason some folks consider making a switch to Chime is because they hear it doesn't charge certain fees that other places might. This can be a really attractive point for anyone trying to save a bit more of their hard-earned cash. So, for many, the idea of avoiding those extra costs makes Chime seem like a very appealing option for their day-to-day money needs. This is definitely something people weigh when they consider if Chime is a good fit for them.

Early Impressions and Money Movement with Chime

The initial experience with Chime, like getting a card delivered quickly, often sets a positive tone. People appreciate that kind of speed and straightforwardness. When it comes to moving money around, the promise of fewer fees is a significant draw. It’s about making your money go further, really. These early impressions and the way Chime handles money movement are big factors in how people view the service. If we think about a "Chime glitch 2025," these positive aspects could be affected, which is why it's something people might worry about.

What Happens When Things Go Wrong?

This is a big question for anyone using a financial service: "What happens when things go wrong?" Some people have shared that when they run into a situation that needs fixing, like a problem with their account, Chime can be, well, not the best. There's a feeling among some users that when a real issue comes up, they might not get the kind of help or protection they really need. This kind of feedback comes from folks who've had accounts open for a while, like since 2016, so it's based on some real-world experience, you know.

The concern about protection is pretty serious. People want to feel safe knowing their money is looked after and that if something goes sideways, there's a clear path to getting it sorted out. If there's a perception that the service might not protect you as much as you'd like when a difficulty arises, that can be a real worry. This is especially true when you start thinking about the idea of a "Chime glitch 2025" and what that might mean for personal funds if support isn't as helpful as one might hope.

Addressing Concerns About User Protection and the Chime Glitch 2025

The worries about user protection are a key point for many who use or are thinking about using Chime. People want reassurance that their funds are secure and that if an unexpected event, like a "Chime glitch 2025," were to happen, there would be clear steps to take and reliable assistance available. The experiences of those who felt unprotected in past situations definitely highlight the need for clear communication and strong support systems, especially if future technical difficulties were to arise. It’s about trust, really, and making sure that trust is well-placed.

Can a "Chime Glitch 2025" Affect Your Credit Building?

Many people are trying to build up their credit, and Chime offers a credit builder card that sounds pretty interesting. But, you know, there can be some confusion about how it all works. People have questions and try to do their own digging before asking for more information. They want to make sure they understand the ins and outs of how this card helps them create a better financial standing. This means they are trying to figure out the specifics of the card and how it reports to the credit bureaus.

The idea of a "Chime glitch 2025" brings up a whole other layer of questions for those using the credit builder card. If there were to be some kind of unexpected hiccup, could it mess with the credit history they're working so hard to establish? People worry about their efforts being undone by something out of their control. It’s a pretty important thing to consider, as building credit takes time and consistent effort, and any sort of interruption could set someone back. So, clarifying how the credit builder card works, and what protections are in place for it, becomes even more important.

Sorting Out the Chime Credit Builder Card and Future Glitch Worries

The Chime credit builder card is a tool many people use to improve their financial standing, and understanding its workings is important. People often have specific questions about how it helps them build a good credit record. The thought of a "Chime glitch 2025" naturally leads to concerns about the stability of that credit-building process. If there were to be a technical issue, could it disrupt the reporting of payments or the overall progress? These are valid worries for anyone trying to get their finances in a better place, so, you know, clarity on how such a card would be protected during an unforeseen event is quite helpful.

How Does Chime Compare to Other Services for Early Payments?

People often ask about getting their money a little sooner, especially for things like SSI payments. They wonder, "Do Chime and Go2Bank have the same five business days early for SSI?" This is a pretty common question because getting funds a few days ahead of time can make a real difference for managing bills and daily life. It’s a feature that many look for when choosing a service for their regular income. So, comparing how different services handle these early payment schedules is a very practical thing to do, you know, for personal budgeting.

The ability to receive payments earlier is a significant draw for many users. It offers a bit of breathing room and can help with planning. If there were to be a "Chime glitch 2025," a potential concern could be how such an event might affect these early payment schedules. Would payments be delayed? Would the system for early access be disrupted? These are the kinds of questions that naturally come up when you rely on a service for timely access to your funds. Understanding the consistency of these early payment features across different platforms helps people make informed choices about where to keep their money.

Understanding Early Payment Schedules and a Potential Chime Glitch in 2025

For many, receiving payments a few days ahead of the usual schedule is a big plus, and services like Chime are known for this. The question of whether Chime offers the same early access as others, like Go2Bank for SSI, is a common one, as people are always looking for the best way to manage their money flow. If we think about a "Chime glitch 2025," a key worry would be any interruption to these early payment arrangements. People depend on that early access for their budgets, so, you know, any sort of delay or problem could create real difficulties. It’s a practical concern that highlights the importance of consistent service.

What About the Technical Side of Things?

Sometimes, discussions about Chime go beyond just banking services and touch on some pretty specific technical issues. For example, someone mentioned that "the chime doesn’t work at all with the puck attached." This sounds like it's talking about a smart home device, maybe a Nest product, where a chime sound is supposed to happen, but it just isn't. The person even worked with Google support quite a bit, trying all sorts of things like resetting everything and flipping cables on the Nest puck, but still no luck. This shows that technical quirks can happen with products that interact with Chime, or maybe even with the app itself in some less obvious ways.

Another interesting technical detail mentioned is about an "auto correct" feature that "drops the chime lever a little deeper after the 3/4 chime, needing the bigger lift for the hour chime to pick it up and start the chimes on the hour." This sounds like a very specific mechanical or software timing issue, perhaps related to an actual physical chime or a digital one. It suggests that even small, precise adjustments in a system can lead to unexpected behaviors. These kinds of subtle technical details, while seemingly unrelated to money, can sometimes point to the overall complexity of a system. If we consider a "Chime glitch 2025," it might involve these kinds of hidden technical interactions, making things a bit tricky to sort out, you know, if something were to go wrong.

Peculiar Technical Quirks and the Idea of a Chime Glitch in 2025

There are some rather specific technical observations that have come up, like a chime not working with a certain device, even after a lot of troubleshooting. This suggests that the way Chime interacts with other systems, or its own internal workings, can have some unexpected behaviors. The mention of an "auto correct" feature affecting a "chime lever" also points to a very detailed, almost mechanical-sounding, software adjustment. These kinds of peculiar technical quirks, while not directly financial, show that even complex systems can have their odd moments. Thinking about a "Chime glitch 2025," it's these subtle, underlying technical layers that could potentially be involved, making any future issues a bit more involved to figure out, you know.

Do Chime and Its Partners Stand Behind Everything?

It’s pretty common for companies, especially those dealing with money, to have disclaimers. And Chime, along with The Bancorp Bank, is no different. They make it clear that they "neither endorse nor guarantee any of the information, recommendations, optional programs, products, or services advertised, offered by, or made" by others. This means that while they provide the core service, they're not necessarily vouching for every single thing you might see or hear that's related to them, but not directly from them. It’s a way for them to draw a line, you know, between what they are directly responsible for and what falls outside their direct control.

This kind of statement is important because it sets expectations. If someone sees an advertisement or hears a recommendation about something related to Chime, this disclaimer tells you that Chime and its partner bank aren't necessarily putting their stamp of approval on it. It means you should probably do your own checking before acting on such information. When we think about a "Chime glitch 2025," this disclaimer could become relevant if, say, an issue arose from a third-party service or product that users thought was connected to Chime. It highlights the importance of understanding the boundaries of their responsibility.

Unpacking the Disclaimers and What They Mean for a Chime Glitch 2025

When you use any service, it's pretty helpful to know what the company stands behind and what it doesn't. Chime and The Bancorp Bank make it clear that they don't, you know, officially support or promise anything about information or other offerings that aren't directly from them. This kind of disclaimer is there to set boundaries. If we consider the idea of a "Chime glitch 2025," this could be important. It means that if a problem were to come from something outside their direct control, like a third-party service, their responsibility might be limited. So, understanding these statements helps people know what to expect and where the lines of accountability are drawn.

What Could a "Chime Glitch 2025" Mean for You?

So, after looking at all these different aspects of Chime – how it works, what people say about its support, the credit builder card, early payments, and even those technical bits – what does the idea of a "Chime glitch 2025" really suggest for you? It's not about predicting something will definitely happen, but more about thinking through the possibilities. If there were a widespread technical issue, or, you know, a system hiccup, it could mean temporary delays in accessing your money, or maybe even a brief pause in services like early direct deposits. For those building credit, a glitch might cause a moment of worry about reporting, though typically these things get sorted out.

The key takeaway here is pretty much about being prepared and aware. Knowing that Chime is a financial technology company working with a bank, rather than a bank itself, helps you understand the structure. If a "Chime glitch 2025" were to occur, the way it might affect you would depend on the nature of the problem. It could range from a minor inconvenience, like a temporary app slowdown, to something more significant that requires communication with customer support. Having a bit of a backup plan, like a small amount of cash on hand or access to another account, is always a sensible approach, you know, for any financial service you use.

Preparing for the Unexpected with the Chime Glitch 2025

Considering all the different aspects of Chime, from how it handles money to user experiences and technical details, the thought of a "Chime glitch 2025" is really about being ready for anything. It’s not about fear, but about thinking ahead. If such a thing were to happen, it could mean temporary difficulties with things like getting your money or using your card. For those working on their credit, there might be a moment of concern, but, you know, these sorts of things usually get fixed. The main point is to be aware of how the service works and to have a bit of a plan for unexpected moments, just in case. It’s simply a good practice for anyone using a digital money service.

This article has explored various facets of Chime, drawing from user experiences and technical observations, all while considering the speculative concept of a "Chime glitch

- Tsjoafitness Onlyfans Leaked

- Mia Khalifa Tongue Out

- Taylor Swift Ass 2024

- Jayde Cyrus Tits

- How Old Is N8noface

Chime - Banking with No Monthly Fees. Fee-Free Overdraft. Build Credit.

Free Online Checking Account | Chime

![Chime Review [2022]: What To Know Before Signing Up](https://www.thewaystowealth.com/wp-content/uploads/2019/07/Chime-Banking-Mobile-App-and-Debit-Card-v2.jpg)

Chime Review [2022]: What To Know Before Signing Up